“The term “multiple benefits” has emerged to describe the additional value that emerges with any energy performance improvement. The benefits that occur onsite can be especially meaningful to manufacturing, commercial, and institutional facilities. Energy efficiency’s positive ripple effects include increased productivity and product quality, system reliability, and more. ”

Source: aceee.org

>” […] Over the past few decades, researchers have documented numerous cases of energy efficiency improvements—almost always focusing exclusively on energy savings. Non-energy benefits are often recognized, but only in concept. ACEEE’s new report, Multiple Benefits of Business-Sector Energy Efficiency, summarizes what we know about the multiple benefits for the business sector. True quantification of these benefits remains elusive due to a lack of standard definitions, measurements, and documentation, but also in part because variations in business facility design and function ensures that a comprehensive list of potential energy efficiency measures is long, varied, and often unique to the facility.

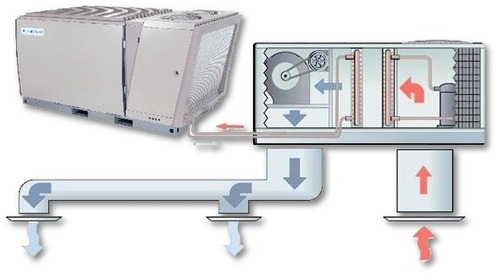

To give some concrete examples of non-energy benefits at work: Optimizing the use of steam in a plywood manufacturing plant not only reduces the boiler’s natural gas consumption, it also improves the rate of throughput, thus increasing the plant’s daily product yield. A lighting retrofit reduces electricity consumption while also introducing lamps with a longer operating life, thus reducing the labor costs associated with replacing lighting. In many instances, monitoring energy use also provides insights into water or raw material usage, thereby revealing opportunities to optimize manufacturing inputs and eliminate production waste. By implementing energy efficiency, businesses can also boost their productivity. This additional value may make the difference in a business leader’s decision to pursue certain capital investment for their facility.

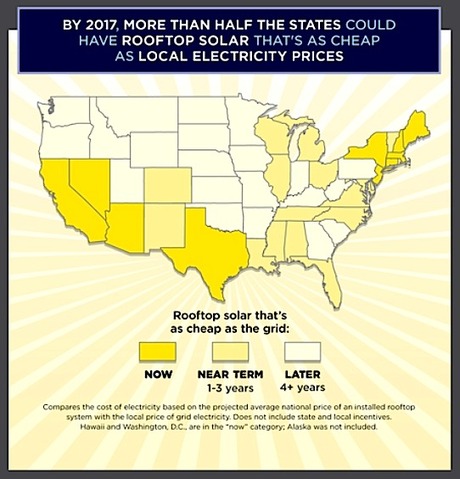

Meanwhile, energy resource planners at utilities and public utility commissions recognize the impact of large-facility energy demands on the cost and reliability of generation and transmission assets. By maximizing consumer efficiency, costs are reduced or offset throughout a utility system. So the ability to quantify the multiple benefits of investing in energy efficiency, if only in general terms, is an appealing prospect for resource planners eager to encourage greater participation in efficiency programs.

Unfortunately, our research shows that this quantification rarely happens, even though the multiple benefits are frequently evident. A number of studies offer measurement methodologies, anticipating the availability of proper data. When these methodologies are employed with limited samples, we see how proper accounting of non-energy benefits dramatically improves the investment performance of energy efficiency improvements—for example, improving payback times by 50% or better. Samples may provide impressive results, but the data remains too shallow to confidently infer the value to come for any single project type implemented in a specific industrial configuration. Developing such metrics will require more data. […]”<

See on Scoop.it – Green & Sustainable News